There is currently no inheritance tax in Malaysia. INHERITANCE TAX There is currently no tax for property inheritance in Malaysia.

Bkash Mobile Money Job Opening Good Communication Skills Job

There is no inheritance tax in Malaysia.

. Consider the following example of one who bought a property in 1977 for about RM20000 Diagram 1. Its only charged on the part of your estate thats above the threshold. Malaysia used to have the Estate Duty Enactment 1941 which served like the inheritance tax.

An inheritance tax was implemented in Malaysia under the Estate Duty Enactment 1941. See the Other taxes section in the Individual tax summary. Its previous version was revoked back in 1991.

In the case of a inherited property stamp duty might become a consideration. At the time assets of a deceased individual valued beyond RM2 mil was subject to an estate tax between 05 and 10. By imposing an inheritance tax on properties the Government is effectively imposing a tax on the inflation suffered by the house buyer.

An inheritance tax was implemented in Malaysia then Malaya under the Estate Duty Enactment 1941. Its only charged on the part of ones estate thats above the threshold. Until then net worth exceeding MYR2 million US543000 was taxed at five per cent and a rate of 10 percent was imposed on net worth exceeding MYR 4 million.

This enables you to find out the amount of RPGT payable in Malaysia quickly so that you can enjoy the best tax savings available. Malaysia - More data and information How high is income tax on residents in Malaysia. However in recent years there have been talks of reintroducing inheritance tax by successive governments.

As mentioned earlier there is currently no inheritance tax in Malaysia the Estate Duty Enactment 1941 having been repealed many years ago on 1 November 1991. An estate s of a dead person is liable to a 5 tax if it is valued above RM2 million and 10 if it is above RM 4 million. Inheritance tax in Malaysia was abolished in 1991.

Graph of house price trends in Malaysia Where to by property in Malaysia vanloma. However it was abolished 1991. Section 4i of the Enactment provides that estate duty is imposed on properties which passes on the death of the deceased.

Property tax Property tax is levied on the gross annual value of property as determined by the local state authorities. If theres inheritance tax to pay its charged at 40 on gifts given in the three years before you die. Do you have to pay tax when you inherit your share of your inheritance.

In laymans terms an inheritance tax was executed in Malaysia under the Estate Duty Enactment 1941. As of Budget 2020 no new laws on inheritance tax have been. Elaborating on capital gains tax Koong said the new proposed tax system would spook.

Property prices in Malaysia. Luxury and excise duties Excise duties are imposed on a selected range of goods manufactured and imported into Malaysia. This means that the taxes affect the rich to give to the poor creating what is hoped to provide equal opportunity for everyone.

But with that being said it is ideal for a beneficiary of inherited property to know the ownership transfer date of the property and its market value at that point in time. The standard Inheritance Tax rate is 40. INHERITANCE No inheritance or gift taxes are levied in Malaysia.

151 rows The standard inheritance tax rate is 40. Is Stamp Duty Payable On Transfer Of Property Between Family Members In Malaysia. The quick answer is no.

Inheritance estate and gift taxes There are no inheritance estate or gift taxes in Malaysia. Taxes arent usually involved but inheritance tax applies to inheritances worth more than 25000. Inheritance tax in Malaysia was abolished back in 1991.

Inheritance and estate taxes are in essence a wealth distribu- tion tax. An estate of a deceased was liable to a five per cent tax if it was valued above RM2 million and 10 per cent if.

Inheritance Taxation In Oecd Countries En Oecd

U S Estate Tax For Canadians Manulife Investment Management

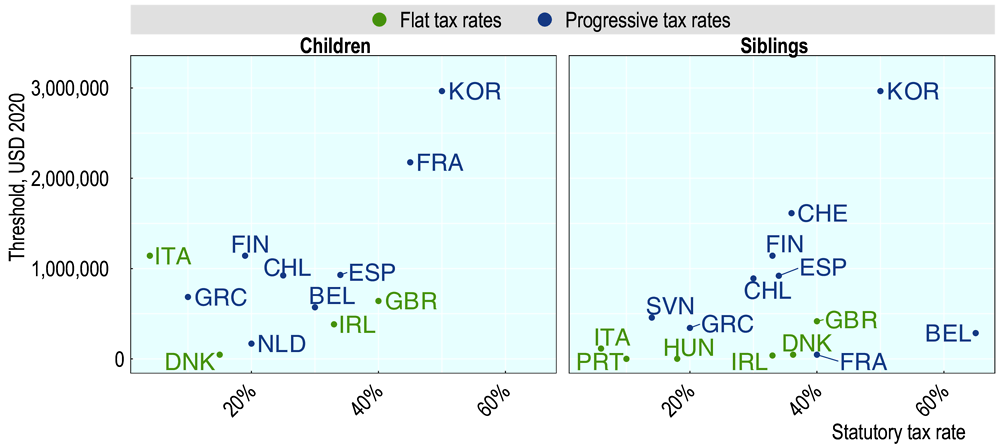

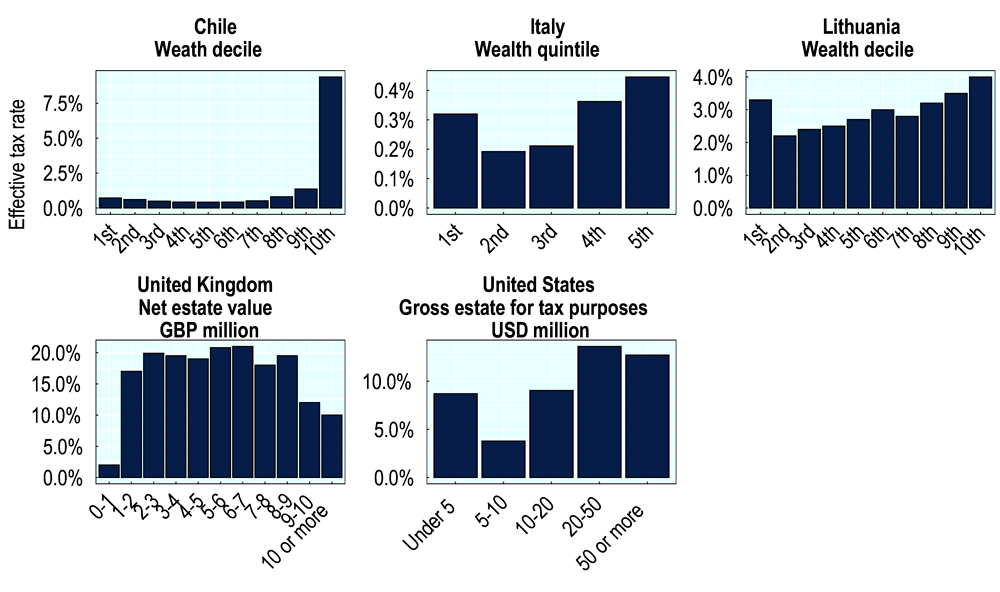

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

1 Nov 2018 Budgeting Inheritance Tax Finance

1 Nov 2018 Budgeting Inheritance Tax Finance

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

10 Jurisdictions With No Inheritance Tax No More Tax

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

Editable Oklahoma Last Will And Testament Template Sample Last Will And Testament Will And Testament Living Will Template

Estate Duty Inheritance Tax Private Client Services By Mercer

Understanding Inheritance And Estate Tax In Asean Asean Business News

On Last Few Weeks 20hb July Sell Back Physical Gold Bar With Affin Bank The Bank Buy Back Policy And Procedure Quite Simple Com Physics Gold Bar Finance Tips

These 22 Sketches Make Complicated Financial Concepts Simple Enough To Fit On A Napkin Business Insider Business Insi Money Concepts Finance Estate Planning